DebtBusters' Money-Stress Tracker 2023 finds South Africans financially fatigued

With the past year bringing additional loadshedding, interest rate hikes, and inflation - without the relief of increasing salaries - South African's are under pressure. This is what we found in our annual Money-Stress Tracker 2023 Survey.

What is the Money Stress Tracker?

The Money-Stress Tracker polled subscribers of the DebtBusters website and platform, tracking the impact of financial stress on their home and work lives as well as their health.

With over 35 000 responses, this is one of the largest surveys ever done in South Africa about how financial stress impacts other aspects of life.

The survey respondents are up more than 20 000 from last year. Read the 2022 report here.

The Results

Three out of four South Africans feel money-stress, more than last year, with particularly women admitting to the effects of financial stress at home and work and on their health. Lower-income earners are the most stressed, while those who earn more have high levels of unsustainable debt.

3 Main Findings:

1. 62% of middle class have unsustainable debt levels

Sixty-two percent of the respondents taking home more than R20 000 had unsustainable debt levels. This income band is the backbone of South Africa’s middle-class population.

2. Four out of five women suffer financial stress

Compared to 2022 both women and men are 10% - 15% more stressed about their finances, work life, home life and health. Four out of five female respondents said they suffered financial stress.

Need debt counselling or consolidation?

Explore DebtBusters' solutions for reducing your interest rates and unlocking cash.

Find out more

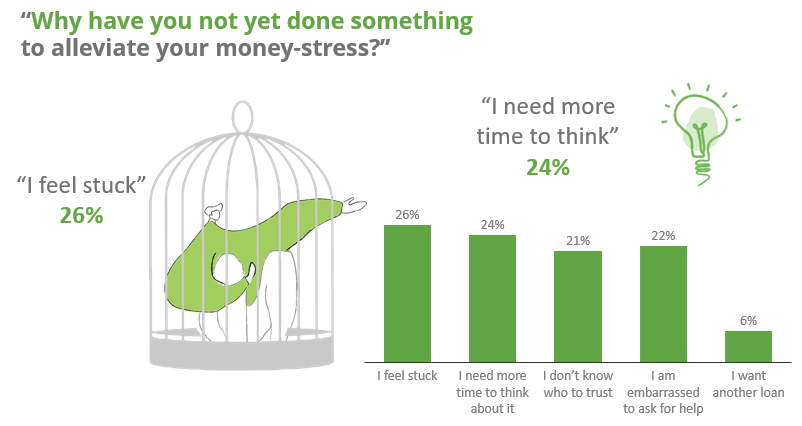

3. Inaction, embarrassment, lack of trust inhibits positive action

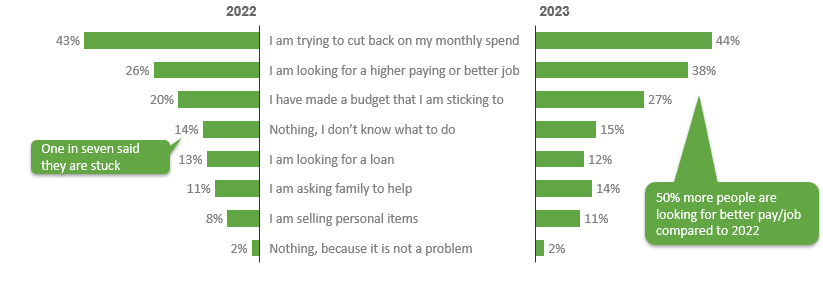

When asked why they haven’t acted to relieve money stress, the majority of under 35s said they feel stuck or embarrassed. Those aged 45 and up say they don’t know who to trust or want more time to think. The survey found that less than 15% of people with unsustainable monthly debt repayments take any positive action.

To deal with money stress all age groups said they were cutting back on spending, a strategy that on average 44% of respondents have adopted. This year 38% said they were looking for a better job or higher pay, up nearly 50% on last year.

Conclusion

While there is help out there, people are either too weary to seek it out or they are unaware of it. DebtBusters' goal is to reach as many people as possible, and show them that there is a path to a debt free life.

Read the full Money-Stress Tracker 2023 press release.

Download the detailed results of the 2023 Money-Stress Tracker.