While there was much bad news this quarter - including increased unsecured debt levels, a higher debt-to-income ratio than ever, and declining real income due to inflation - there was positive news too. We found that the number of consumers completing debt counselling and becoming debt-free has taken a sharp increase.

Gain access to more insights below:

The latest debt index can be downloaded here.

Based on the results from the report, DebtBusters said this to the public:

South African consumers’ debt situation is getting worse with the average debt-to-income ratio at its highest level ever, but there is some good news with more people seeking help and a significant increase in those successfully completing debt counselling.

This is according to the DebtBusters’ 2021 Q2 Debt Index, which tracks client trends quarter-on-quarter and over the past five years,

In the second quarter enquiries about debt counselling increased by 18% compared to a year ago. Benay Sager, head of DebtBusters, attributes this to the after-effects of the nationwide lockdown and a narrowing of consumers’ ability to borrow.

He says that the debt levels have increased substantially and the number of open accounts have decreased for consumers applying for debt counselling, both of which indicate that consumers are seeking help sooner.

The pool of consumers borrowing has also shrunk, as supported by National Credit Regulator data, which indicates average unsecured loan size has increased by 46% and number of loans has decreased by 31% over the last four years.

Compared to the same period five years ago the Debt Index found:

- Real income is declining as inflation continues to bite: Nominal incomes were, on average, 3% higher than in Q2 2016, but when cumulative inflation growth of 24% is factored in, real incomes have shrunk by 21%.

- The debt-to-net-income ratio is at an all-time high: Consumers enquiring about debt counselling are spending around 60% of their take-home pay to service debt. More concerning is that across all income bands the debt-to-income ratio is now at 122% and 152% for those taking home R20 000 or more.

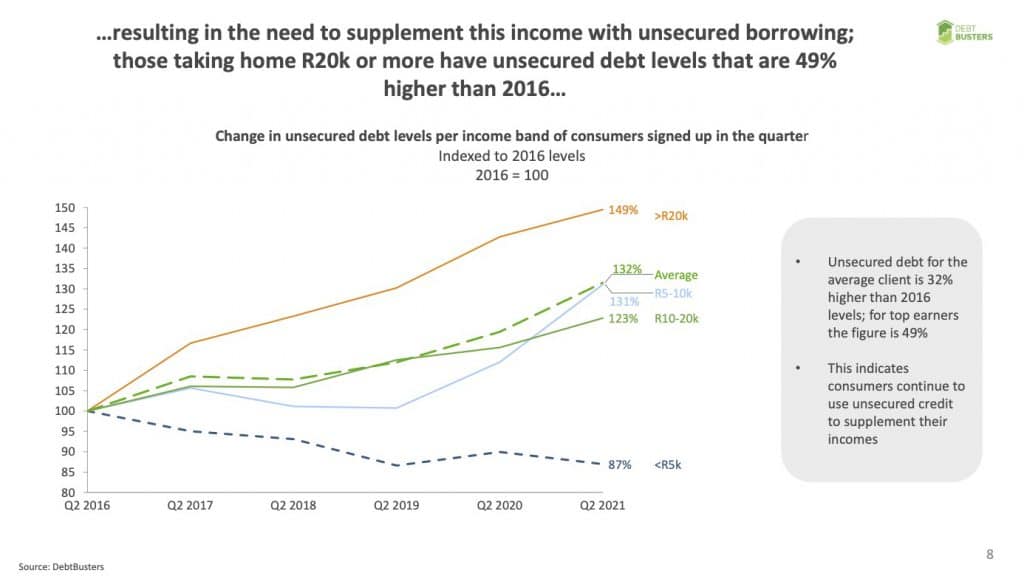

- Unsecured debt level continues to increase: The level of unsecured debt is on average 32% higher than in 2016 and up by 49% amongst consumers taking home R20 000 or more. This is a direct result of consumers using unsecured debt to offset the erosion of their take-home pay.

Sager says despite all the bad news, which is perhaps unsurprising given the impact of successive lockdowns on an already struggling economy, there were some positive findings that show debt counselling works:

Need debt counselling or consolidation?

Explore DebtBusters' solutions for reducing your interest rates and unlocking cash.

Find out more- More consumers successfully complete debt counselling: There are now seven times as many consumers completing debt counselling as there were in 2016.

- Effective mechanism for paying back debt: Consumers who successfully completed debt counselling in Q2 2021 paid back R320m worth of debt to their creditors as part of the debt counselling process

He says the fact that 56% of applicants for debt counselling are male is also positive. In Q2 2016 more women (52%) than men (48%) were applying for help to restructure their debt.

“In a society where men typically tended not to want to talk about or seek help with debt, it’s encouraging that men are becoming more proactive about dealing with debt problems.”

Note to editors: DebtBusters is South Africa’s leading and largest debt counsellor. The quarterly Debt Index is compiled from data provided by clients who have applied for debt counselling over the past five years.

Benay Sager Head of DebtBusters