Debt review is a process that helps South African consumers manage their debts in a more affordable way. However, many people may wonder why debt review fees need to be paid to debt counsellors. Let’s discuss the importance of paying these fees and the benefits they provide.

The Role of Debt Counsellors in Debt Review

Debt counsellors are qualified professionals registered with the National Credit Regulator (NCR). They are responsible for guiding consumers through the debt review process and negotiating with creditors on the behalf. Debt counsellors also play a critical role in ensuring that consumers are protected from harassment by creditors during the debt review process.

The Importance of Debt Review Fees

Debt review fees are paid to debt counsellors for their services. These fees are an essential aspect of the debt review process and are necessary to cover the costs associated with the process. Debt counsellors are required by law to charge reasonable fees for their services, and these fees are regulated by the NCR.

How Debt Counsellors Use Fees to Assist You

Debt counsellors use the fees paid by consumers to provide a range of services, including debt counselling, debt management, and negotiation with creditors. These services are essential for consumers who are struggling with debt and need professional help to manage their finances. Debt counsellors also provide ongoing support and guidance to consumers throughout the debt review process.

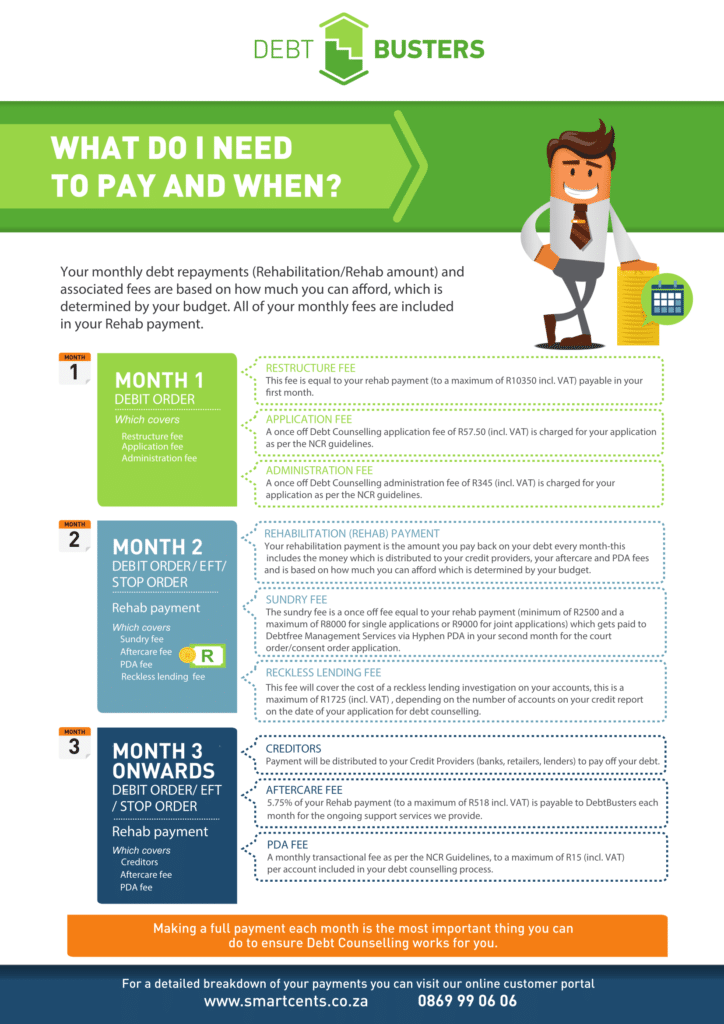

Debt Counselling is a formal process, which is governed by the National Credit Act. Your monthly debt repayment amount is specific to your situation and how much you owe on your debt in total. Debt Counsellors are permitted by the NCR to charge certain fees which include:

- A once off Restructuring Fee of 100% of your debt rehabilitation amount up to a maximum as per the NCR’s guidelines.

- A once off Application Fee

- A once off Administration Fee for your application as per the NCR guidelines.

- A Sundry Fee equivalent to your monthly debt rehabilitation amount for your legal application to the NCT or Magistrate Court.

- A Reckless Lending Fee , which covers the cost of a reckless lending investigation done on the client's account as regulated by the NCR.

- A monthly Aftercare Fee for your monthly debt rehabilitation amount for every month that you are under debt counselling.

- A monthly Transactional Payment Distribution Fee (PDA) as per the NCR. Here is a simple breakdown of what you will need to pay and when:

Need debt counselling or consolidation?

Explore DebtBusters' solutions for reducing your interest rates and unlocking cash.

Find out moreThe Consequences of Not Paying Debt Review Fees

If consumers do not pay their debt review fees, they may be excluded from the debt review process. This means that they will no longer be protected from legal action, repossession, and garnishee orders. Non-payment of debt review fees may also result in additional fees and charges from creditors, making it even more difficult for consumers to manage their debts.

How Debt Review Fees Are Determined

Debt review fees are determined by the NCR, and debt counsellors are required to charge reasonable fees for their services. The fees charged by debt counsellors are based on the amount of debt being reviewed, the complexity of the case, and the services provided. Consumers can request a breakdown of the fees charged by their debt counsellor at any time.

In conclusion, debt review fees are an essential aspect of the debt review process in South Africa. These fees are necessary to cover the costs associated with debt counselling, debt management, and negotiation with creditors. Debt counsellors provide critical services to consumers who are struggling with debt and need professional help to manage their finances. Failure to pay debt review fees can have serious consequences, including exclusion from the debt review process and additional fees and charges from creditors.

What happens if I don't pay my debt review fees?

If you don't pay your debt review fees, you may be excluded from the debt review process and lose the protection it provides. You may also face additional fees and charges from creditors.

How are debt review fees calculated?

Debt review fees are determined by the National Credit Regulator and are based on factors such as the amount of debt being reviewed, the complexity of the case, and the services provided by the debt counsellor.

Are debt review fees a once-off payment?

No, debt review fees are usually paid on a monthly basis for the duration of the debt review process. However, the total amount of fees charged by the debt counsellor will be agreed upon upfront and included in the debt restructuring plan.

Can I negotiate the debt review fees charged by my debt counsellor?

While you cannot negotiate the fees charged by your debt counsellor, they are legally required to charge reasonable fees for their services. If you have concerns about the fees charged, you can request a breakdown of the fees or contact the National Credit Regulator for assistance