DebtBusters' Money-Stress Tracker uncovers SA's financial concerns

South Africa’s population experiences a broad variety of income levels, which means different people experience different levels of financial stress. However, millions in the country are over-indebted, meaning that a large portion of citizens are under immense pressure.

With the impact of inflation, interest rate hikes, and a lack of increasing income, South Africans’ home and work lives and mental health may be impacted. We wanted deeper insights on this potential impact, to educate people and to help us provide better assistance to those who approach us.

This is why we introduced the Money-Stress Tracker.

What is the Money-Stress Tracker?

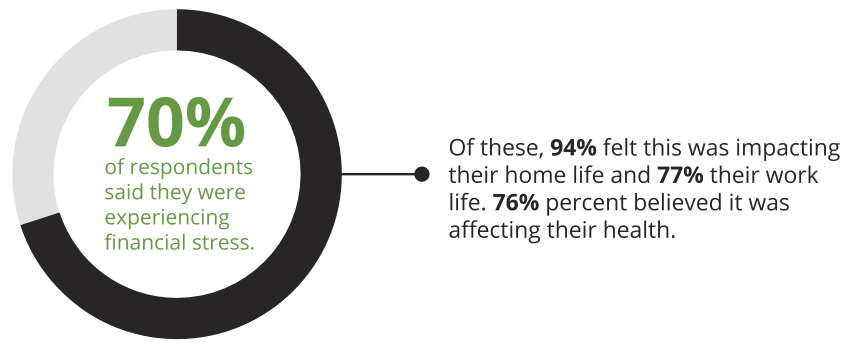

The Money-Stress Tracker polled subscribers to the DebtBusters website and platform, tracking the impact of financial stress on their home and work lives as well as their health.

With over 14 000 responses, this is one of the largest surveys ever done in South Africa about how financial stress impacts other aspects of life.

The Results

1. Financial Stress

2. Gendered Stress

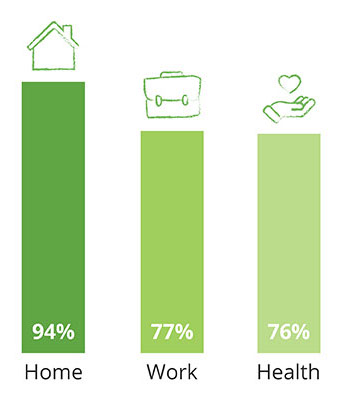

The women surveyed seemed generally more stressed about their finances, home and work life and health than men.

Compared to the men that participated:

30% more women were more likely to be stressed about their health as a result of financial stress, and 20% more women were worried about paying their debt each month.

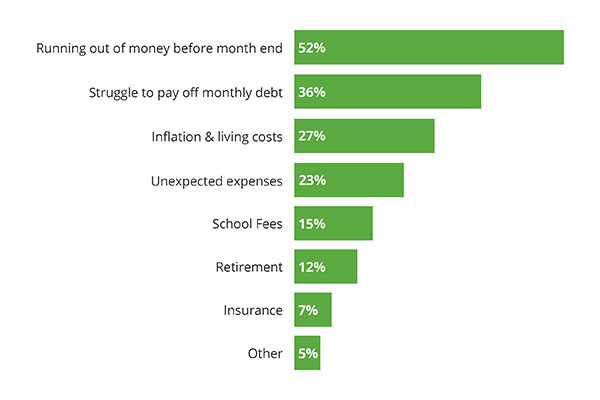

3. The Main Concerns

4. Dealing With the Financial Stress

When it came to facing the financial stress, we found that people had a lot to say.

- 43% opted to tighten their belts.

- 26% looked to increase their income by finding a better job.

- 72% of all respondents need 30% or more of their take-home pay to repay debt — indicating an unsustainable debt position.

When asked why they have not yet done anything to alleviate their money-stress:

- 39% of respondents said that they feel stuck

- 23% of respondents said that they need more time to think

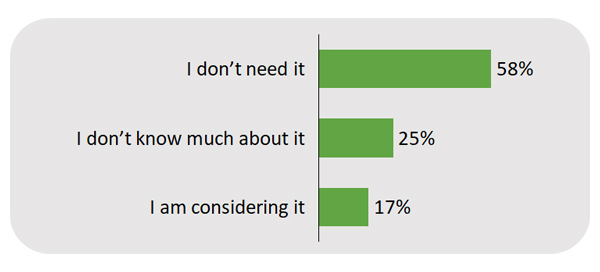

5. What About Debt Counselling?

Having someone you can trust is very important when it comes to debt matters. Most consumers feel they don’t need debt counselling but finding a reputable debt counsellor who can sort out your debt is important.

Need debt counselling or consolidation?

Explore DebtBusters' solutions for reducing your interest rates and unlocking cash.

Find out moreThese were the responses to the question “Have you considered debt counselling?”:

Psychotherapist and Transactional Analyst, Diane Salters says people seeking debt counselling are probably going to feel shame and fear, not be thinking clearly and ready for fight, flight or freeze.

“Those in freeze mode will likely feel stuck. Many responded this way in the survey. Those who are in flight mode will say they don’t need debt counselling when the overall numbers saying they are experiencing the effects of financial stress on their lives indicate they do. If they freeze, they will do nothing. Or they may be ready to flee or fight the debt collector, their partner or spouse or even their debt counsellor.”

6. Other Interesting Findings from the Survey

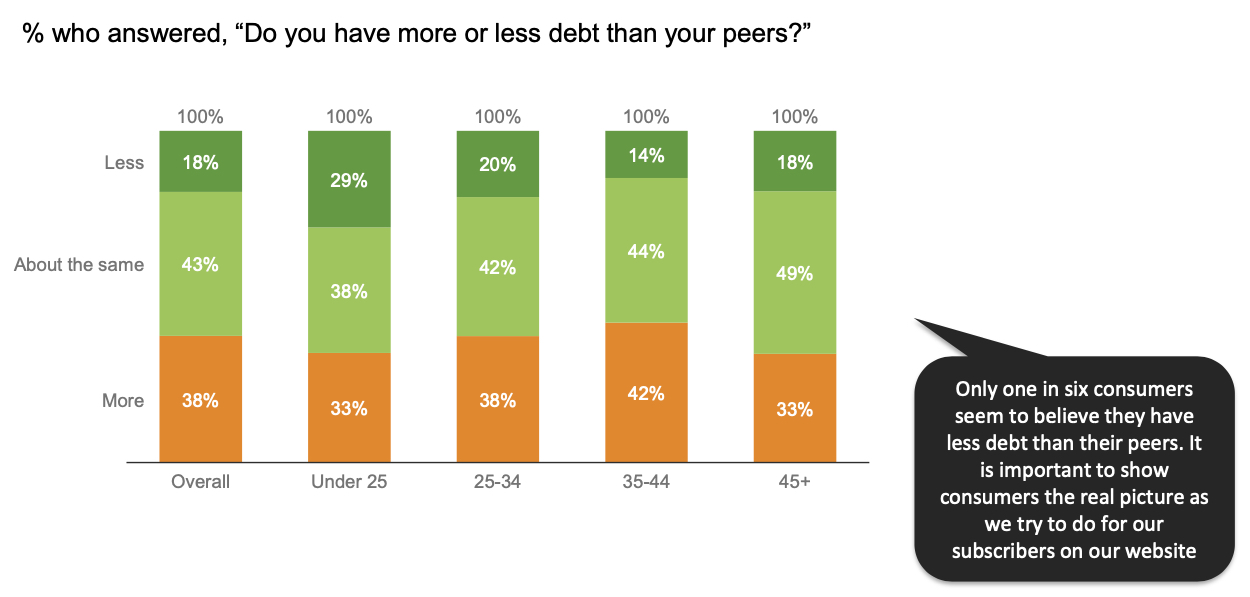

How consumers feel they are doing against their peer groups is critical in trying to keep up. It seems like perception about debt levels is very much age-related.

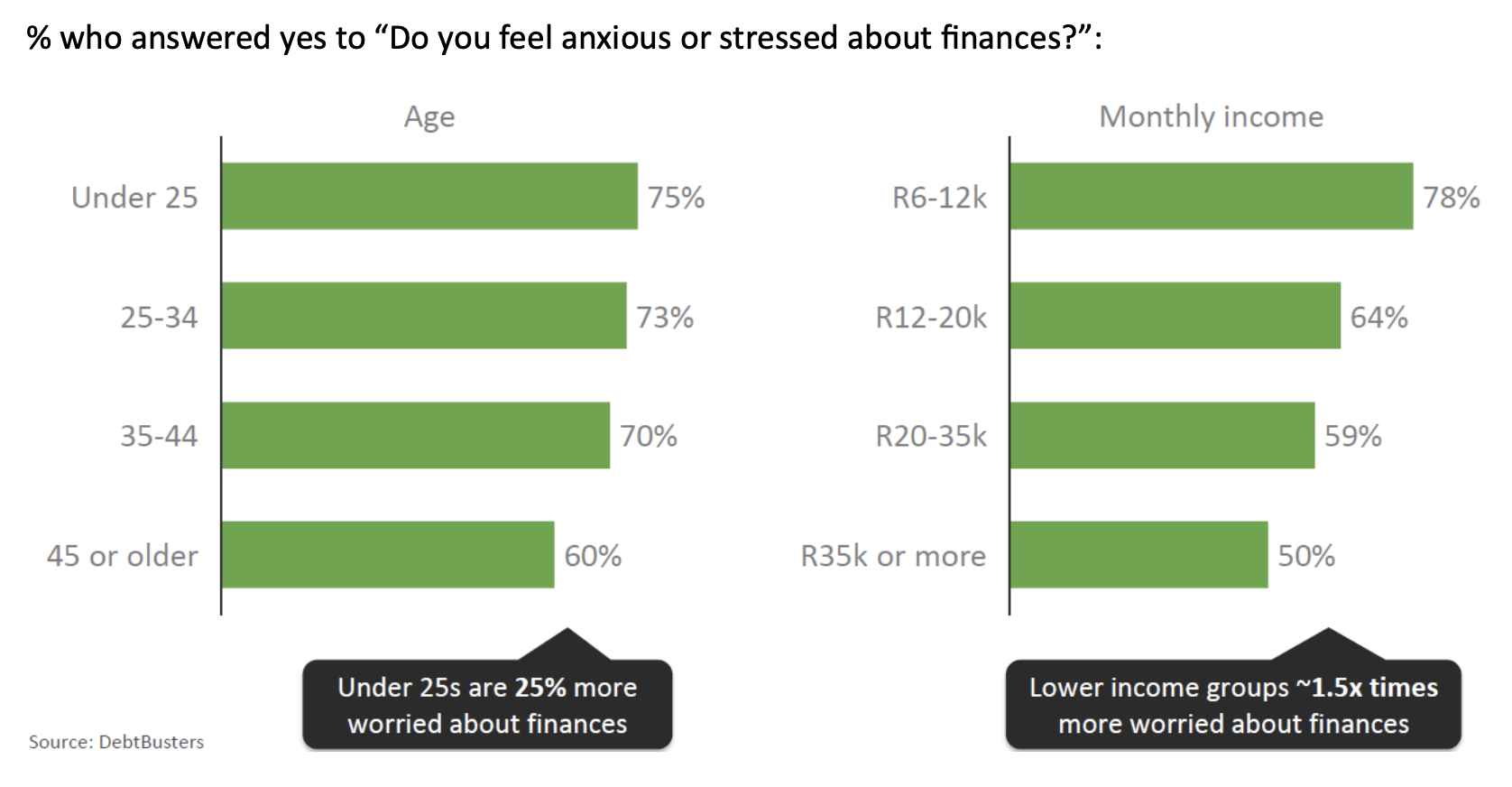

Perhaps unsurprisingly, the level of stress and anxiety about finances is heavily influenced by age and income level: our youngest and those with lower income feel most stressed and anxious

Conclusion

It is clear that people are financially stressed and many don’t know which way to turn. Many are also unwilling to turn to debt counsellors for professional help. The results may indicate a lack of financial education, or other underlying negative beliefs and feelings about struggling financially.

As a society, we should de-stigmatise seeking financial help, and show people that it is actually in their best interest to reach out for assistance.

For further insights from the Money-Stress Tracker, download the results here.