South Africans experience a modest drop in money stress, but key pressures persist in 2025

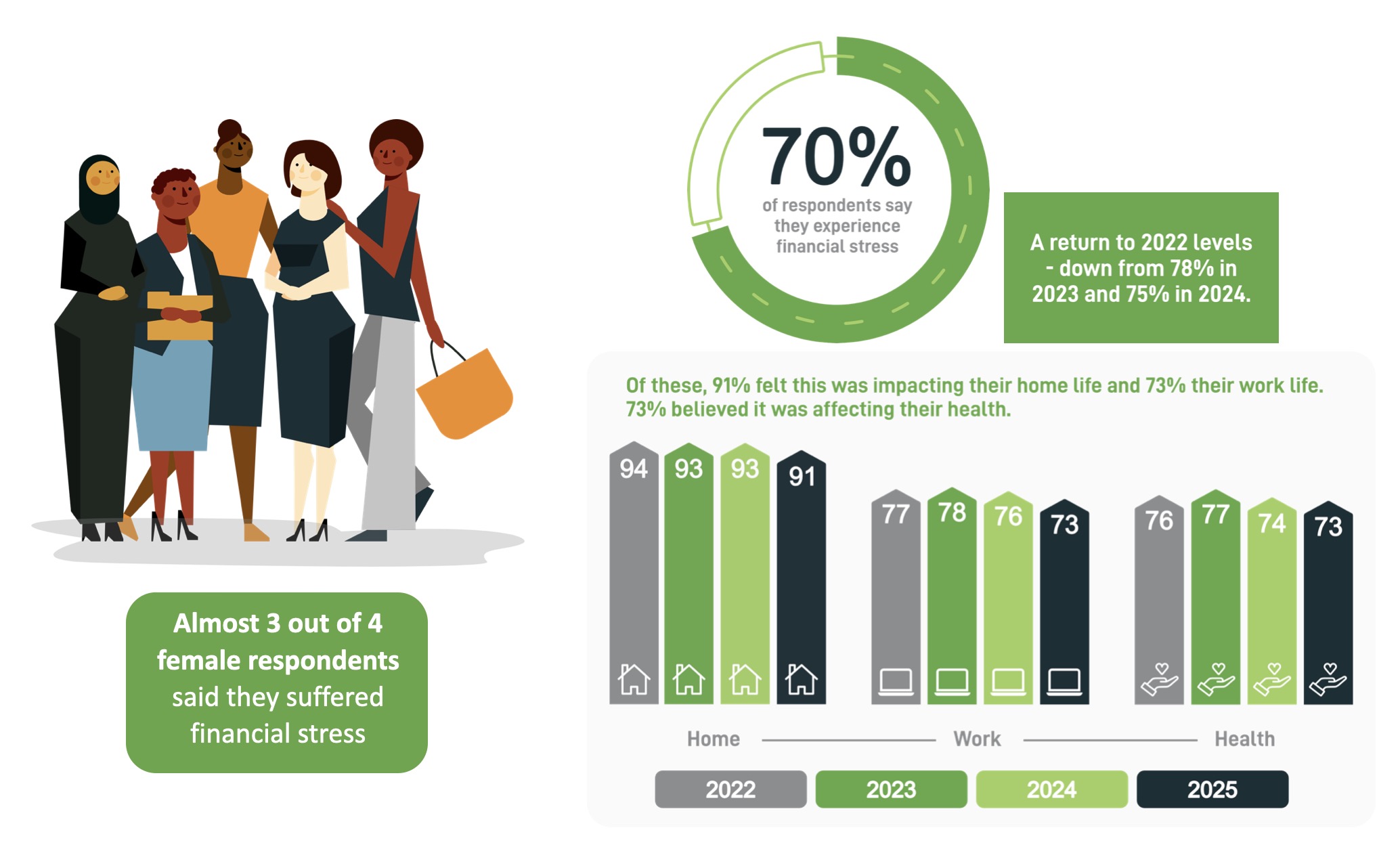

The fourth annual DebtBusters Money-Stress Tracker survey, conducted in May and June 2025 and attracting over 27,000 respondents, reveals a notable decrease in overall money stress compared to the two years prior, marking a return to 2022 levels. However, financial strain remains a significant concern for respondents.

See results from previous years here.

Financial stress and its ripple effect

- 70% of respondents reported experiencing money stress in 2025, a reduction from 78% in 2023 and 75% in 2024. Despite this decline, the impact on daily life remains substantial: 91% felt it affected their home life, 73% their work life, and 73% their health.

- Psychologist Andrea Kellerman notes that a 5% drop in stress in 2025 has led to people sleeping and coping “a bit better,” suggesting a profound impact of small improvements on resilience and perception. This shift is attributed to reduced inflation, fewer national crises such as loadshedding, and a growing sense of agency in managing finances – allowing people to reframe their financial situations and look beyond short-term survival.

- Women continue to bear a disproportionately higher burden of financial stress. Nearly three out of four female respondents reported stress, and they are approximately 10% more stressed about finances and 20% more stressed about work life, home life, and health compared to men. However, stress levels for both genders have decreased by 5-15% across all facets of life since 2024.

Key financial concerns

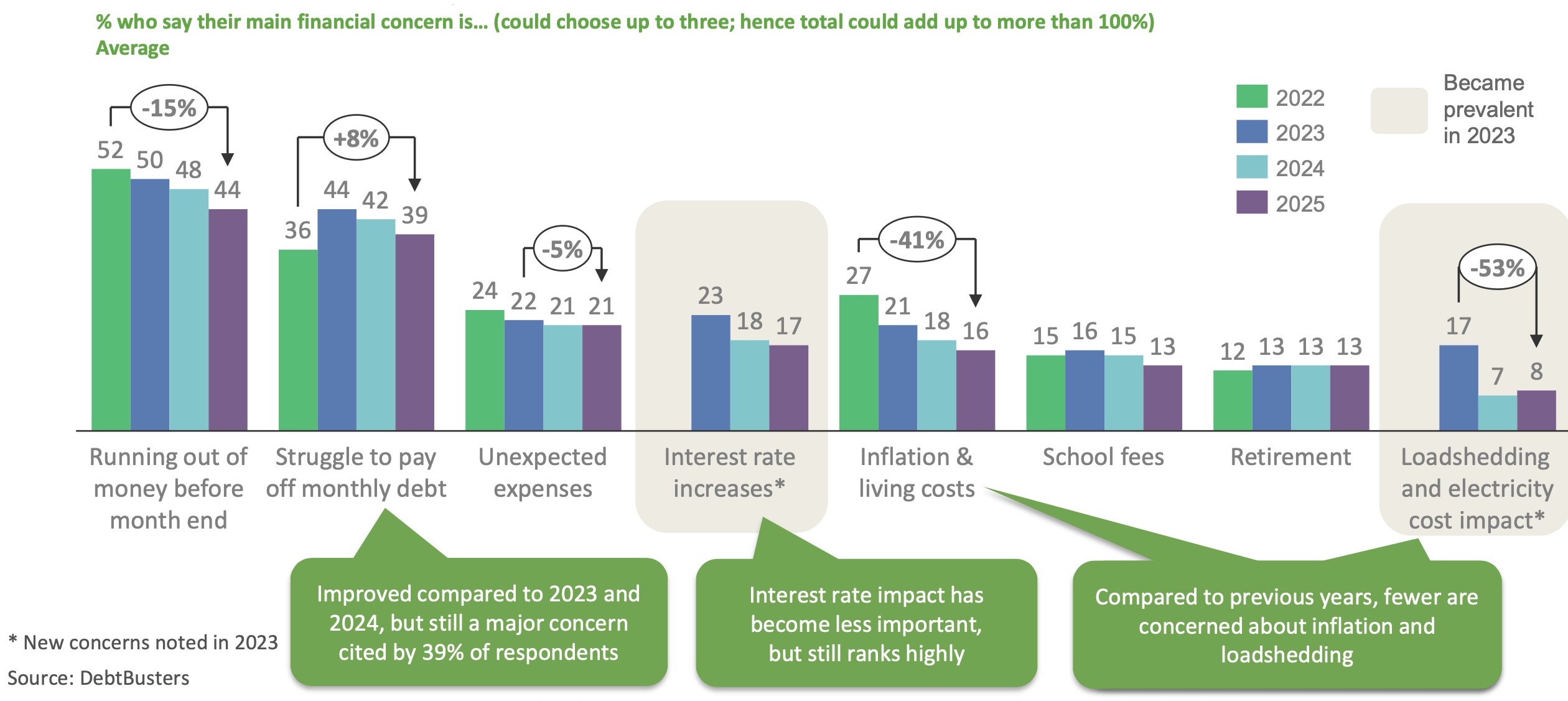

Short-term concerns continue to dominate, with the top two financial worries remaining:

- Running out of money before month-end, and

- Struggling to pay off monthly debt.

The impact of interest rate increases, while still significant, has subsided compared to 2023 and 2024. Concerns about inflation and loadshedding have also eased.

Demographic variations in stress

- Age: Middle-aged individuals (35-44 years) are the most financially stressed. Concerns about retirement have increased for those aged 45 and older compared to 2024, possibly indicating a need for more “breathing room” for this “sandwich generation” cohort.

- Income: Lower-income groups are more concerned about interest rates and unexpected expenses. While electricity costs are an elevated concern across all income groups compared to 2024, retirement worries are more pronounced in upper-income brackets. Interestingly, individuals earning more than R20,000 per month remain among the most financially stressed, often qualifying for and taking on more credit than their earning capacity allows.

- Province: The Western Cape has become the most financially concerned province, surpassing Gauteng, which led in 2024, and also shows the highest concern for unexpected expenses and retirement. Smaller provinces such as the Northern Cape, Limpopo, and Mpumalanga have seen significant increases in concerns regarding interest rates and electricity costs.

Debt repayment and perception

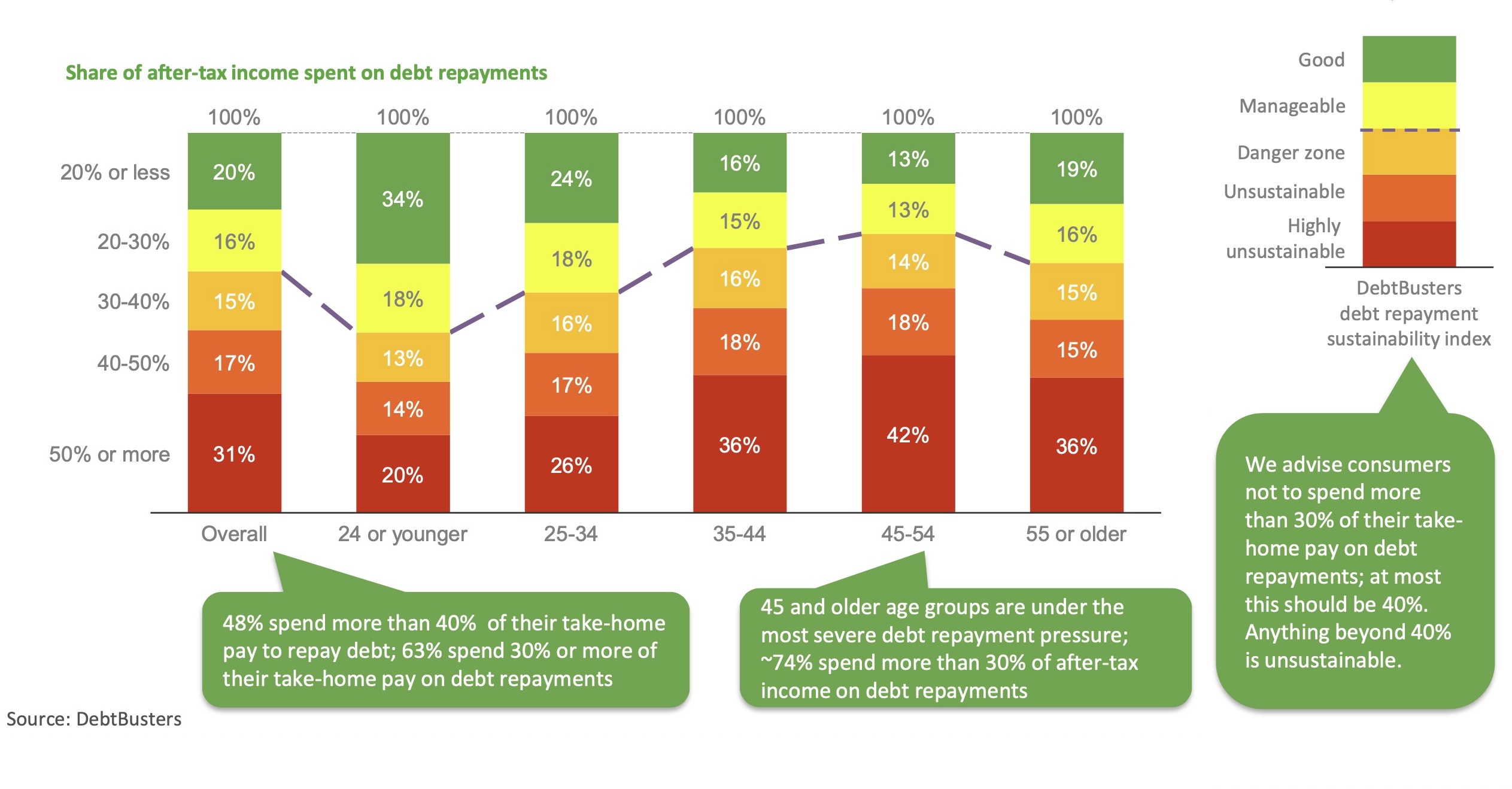

- 63% of consumers allocate 30% or more of their after-tax income to debt repayments, with 48% spending over 40%, a level considered unsustainable.

- The 45 and older age groups are under the most severe debt repayment pressure, with 60% having unsustainable levels of debt.

Need debt counselling or consolidation?

Explore DebtBusters' solutions for reducing your interest rates and unlocking cash.

Find out more- Those earning over R20,000 per month also appear to face considerable debt repayment pressure.

Actions to address money stress

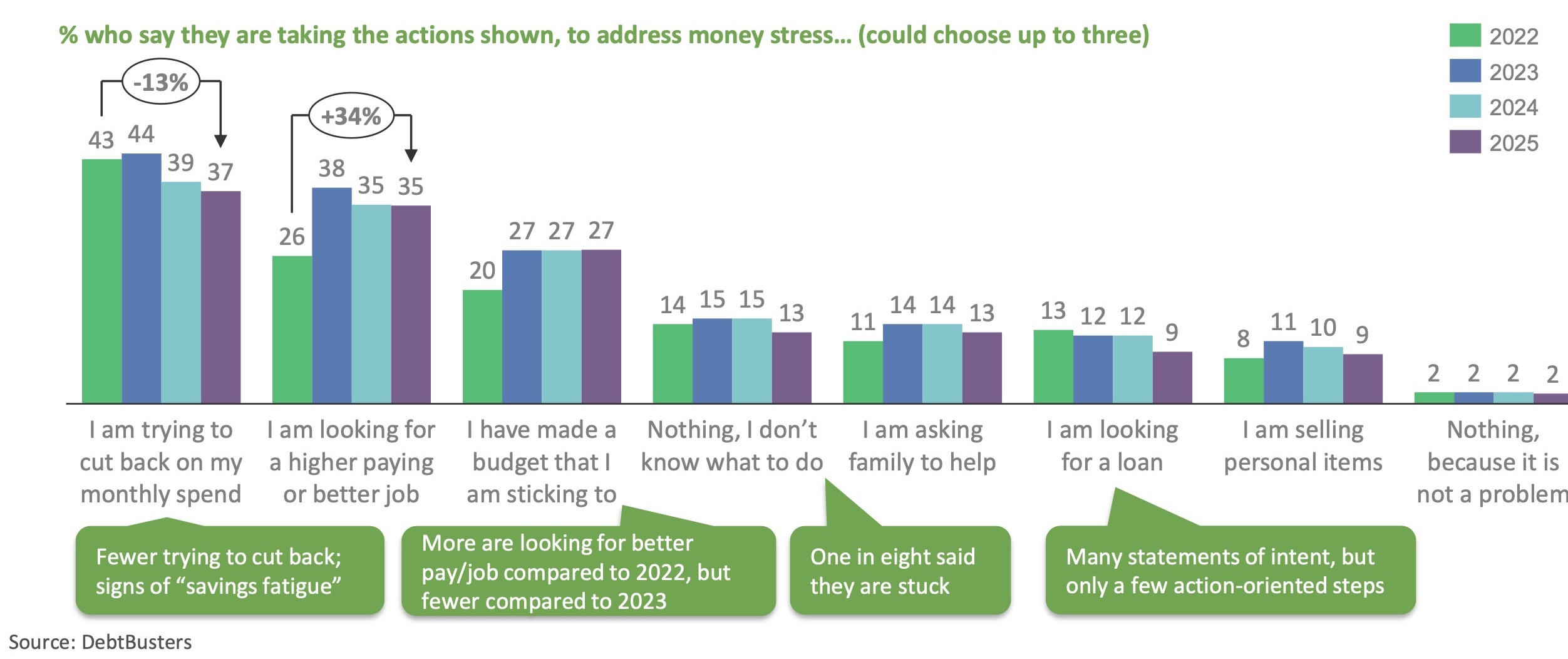

- Fewer consumers are actively cutting back on monthly spending (37% in 2025, down from 43% in 2022), suggesting “savings fatigue”.

- There's a growing trend towards seeking higher-paying or better jobs, with 35% of respondents exploring these options; an increase from 26% in 2022.

- Younger consumers (under 35 years) are more proactive in sticking to budgets and almost four times more likely to seek better employment, demonstrating 56% more intent in managing money stress.

- The open-ended responses recorded in the survey further reveal a shift in coping mechanisms. While 2022 and 2023 were dominated by job seeking and side hustles, and 2024 saw a focus on debt counselling and budgeting, 2025 highlights a growing emphasis on entrepreneurial efforts, multiple income streams, and financial independence – reflecting a move towards self-reliance and creating diverse sources of income.

- Despite the slight reduction in overall stress, over 90% of South Africans with unsustainable debt still do not seek professional support like debt counselling. This underscores the ongoing need for stress management programmes, financial education, and awareness campaigns that address stigma and promote early intervention. It also highlights the need for innovative solutions to deal with money stress, particularly those that help consumers stretch their money further.

Kellerman concludes, “This year has shown us that even a 5% drop in stress can create a ripple effect. With improved sleep, fewer national disruptions, and a growing sense of personal empowerment, South Africans are feeling better equipped to navigate their financial realities.”

Download the detailed results of the 2025 Money-Stress Tracker here.