Did you know you can check account balances – such as your debt review and credit report balances – online, via the DebtBusters platform? This is just one way DebtBusters helps you stay in control of your finances – for free!

If you’re under debt counselling, you can easily monitor your progress on the platform – and if you’re not, you can still track your open accounts, credit score, and much more.

Register on the DebtBusters platform to get started and stay informed on key aspects of your financial life.

What can you do on the DebtBusters platform?

If you’re an existing debt counselling client, you can:

- Stay in control of your finances by understanding your financial position

- Track your debt counselling progress

- See how much you’re saving on monthly payments

- View your past and upcoming payment amounts

- Track your total debt balance

- Check your credit report

- View your insurance solutions

- Get extra support

- Chat with customer services if you need help

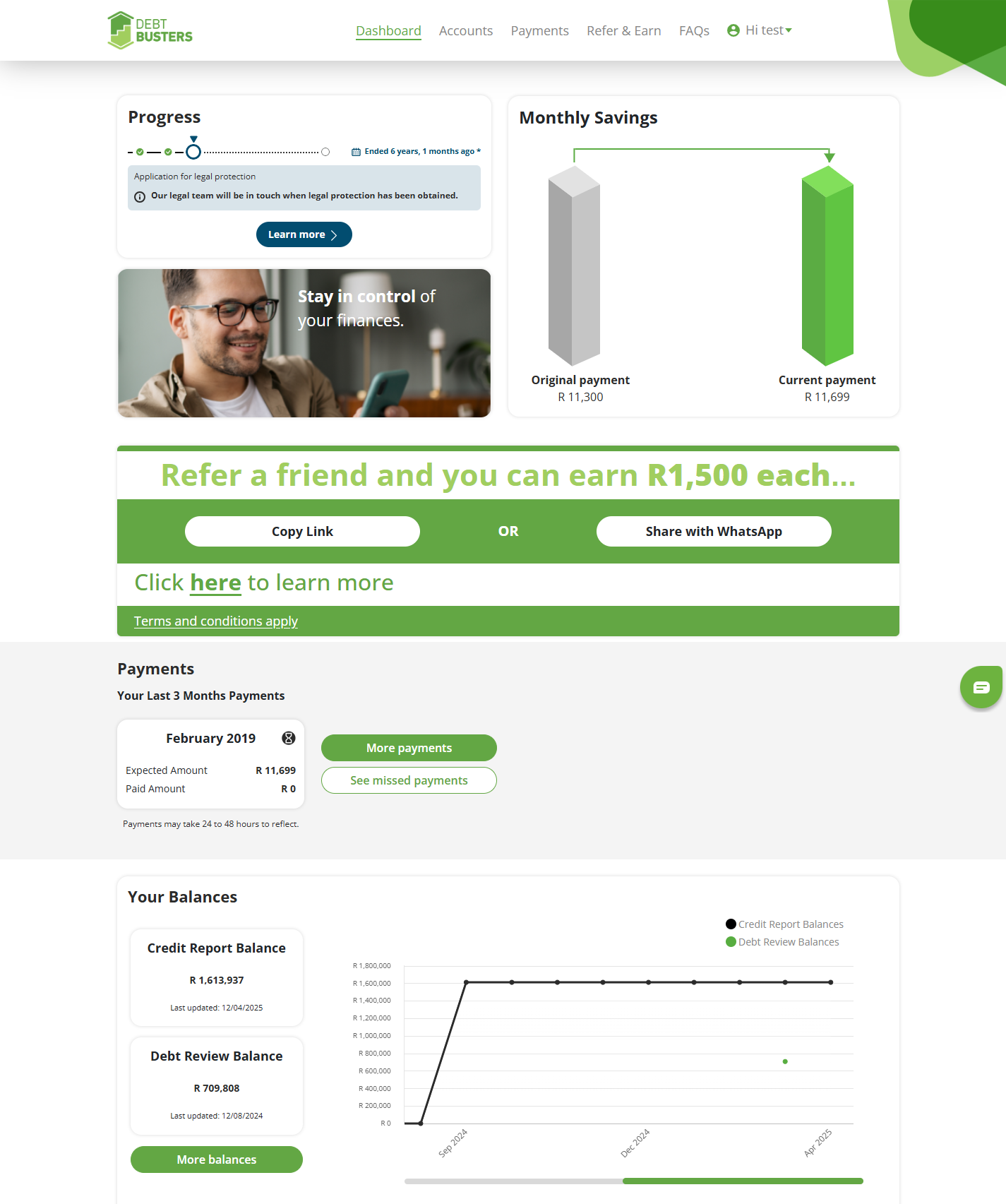

Here’s how your profile might look if you’re a debt counselling client:

** images for display purposes only

If you’re not a debt counselling client, you can:

- Keep track of your finances by reviewing your financial position regularly

- View your credit score

- See your open accounts and amounts owed

- Understand what makes up your total debt

- Understand how creditors and credit bureaus will view your risk profile

- See how much of your salary goes towards paying off debt

- Track your credit history to see if your credit behaviour is improving

- Get a complete picture of your financial health

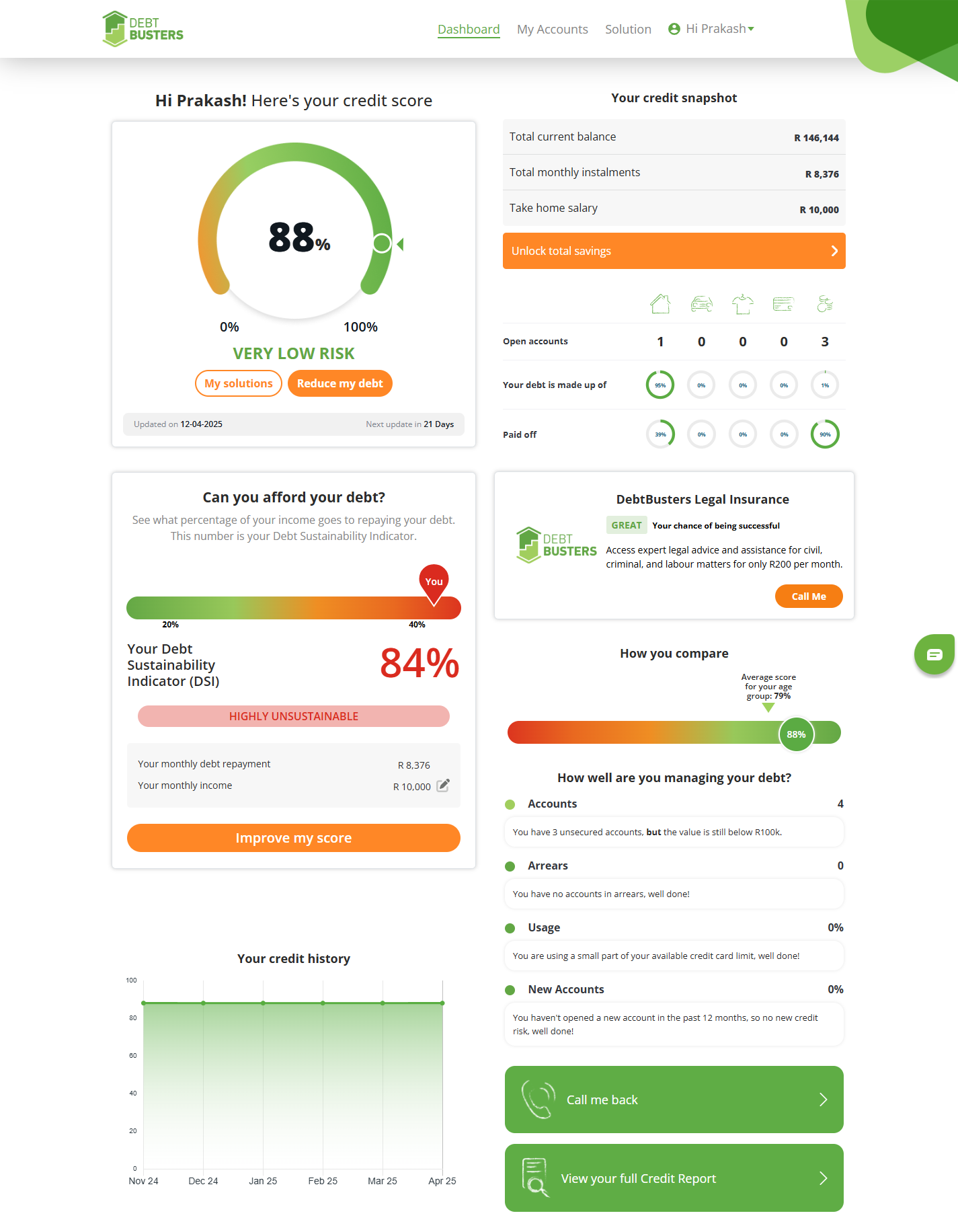

Here’s how your profile might look if you’re not a debt counselling client:

** images for display purposes only

How do I view my account balances online?

If you’re currently a debt counselling client, you would have been prompted during your application process to create an account on the DebtBusters platform – log in, and you’ll see your balances on the Dashboard page within your profile.

If you’re not an existing DebtBusters client, simply visit the DebtBusters platform and follow the prompts to sign up – once your account has been set up, you’ll be able to view your balances on the Dashboard page within your profile.

Need debt counselling or consolidation?

Explore DebtBusters' solutions for reducing your interest rates and unlocking cash.

Find out moreHow can viewing my account balances help me?

Logging in to your DebtBusters account regularly will allow you to stay on track with your account balances, debt breakdown, and payments – which will help guide you towards better financial wellbeing.

1. Track your debt counselling payments

We all want the peace of mind of knowing exactly where our money goes every month.

Viewing your account balances online allows you to:

- See how much you’ve paid so far and how much you still owe

- Check your monthly payments so you can plan ahead

2. Settle smaller balances using your bonus or spare cash

If you’re lucky enough to get a bonus or 13th cheque, you can use it to settle smaller debts more quickly and save on interest by paying off accounts early.

This will ensure that you spend your windfall on something that can make a material difference to your financial situation, rather than on things you may not need.

3. Check your credit score

Monitoring your credit score helps you take the right steps towards a brighter financial future.

By checking your score regularly, you will:

- Understand how your credit score works

- Track your credit use and payment history

- Check whether your debt is sustainable

- Be aware of changes to your score

- Quickly spot errors or fraud on your account

Regular monitoring does not affect your credit score.

4. Stay accountable and on track on your debt counselling journey

Debt counselling can be a long process, and staying the course is not always easy. If you miss payments, you’ll lose the benefits of debt counselling, which include a restructured repayment plan, protection against legal action by your creditors, and lower interest rates.

DebtBusters allows you to monitor your progress and celebrate small wins on the way to financial freedom, keeping you motivated. Remember to keep logging in to stay updated on the latest platform features and updates.

How to know if you may need a debt counselling solution

If you’re overindebted – meaning you owe more than you can afford to repay – debt counselling may be a good solution for you.

Other signs that you may need debt counselling include:

- Struggling to make debt repayments on time

- Using credit to pay for everyday expenses

- Spending more than 30% of your income on debt repayments

- Being harassed by credit providers

- Having garnishee orders against your salary

If you’re feeling overwhelmed by debt, contact DebtBusters. One of our expert consultants will work with you to create a personalised solution tailored to your unique situation.

Let us call you back

Fill out our form below to get a free call-back from one of our consultants to discuss your debt situation.

Jump to form