Are you considering withdrawing from debt counselling? Here is everything you need to know before making the decision

Debt is a big responsibility and can be a heavy weight on your shoulders. The process of getting your debt sorted can be long and frustrating, we understand that.

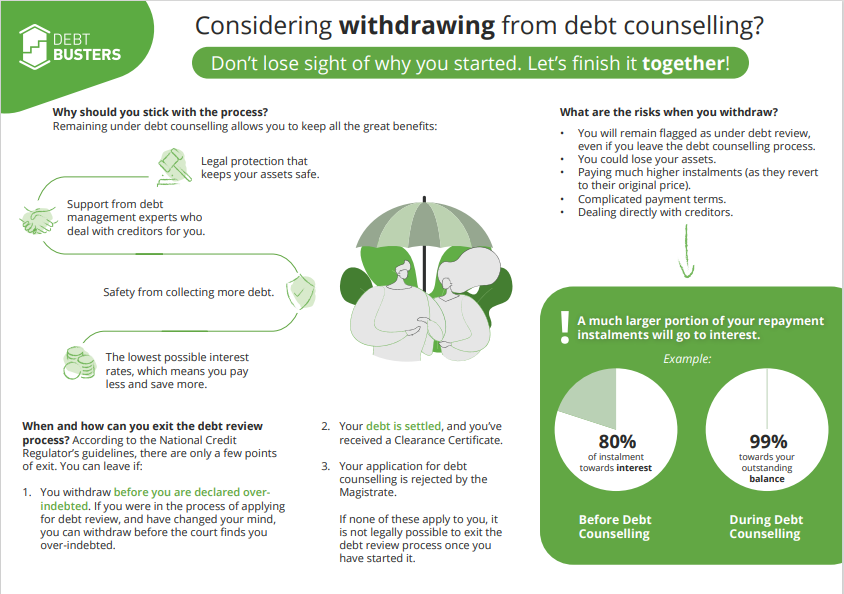

We also understand that it could lead you to consider withdrawing. Unfortunately, withdrawing is not as easy as it used to be. In the past you could simply cancel your debt counselling. These days, the laws are stricter and even if you are removed from debt counselling, you will still be considered as under debt review by the NCR (unless you have paid your debts off, of course).

Really, cancelling is not in your best interest, if you really think about it. You’ll lose all the benefits of being under debt counselling and will still have debts to pay.

Let's consider some of the main reasons people withdraw from Debt Counselling

Before you start the process of withdrawing from debt counselling, consider why you are doing it. Are the reasons you want to withdraw good enough to let go of the assistance that you’re getting from the counselling?

Are you willing to give up the legal protection, extra cashflow, and lower interest rates and go it alone on your debt repayment journey only because you want to avoid making your monthly repayments?

These are the top reasons people give for leaving debt counselling

1. The debt counselling costs you money every month.

While you do make payments monthly, it is important to remember that most of this money goes to your creditors. In other words, it means your debt is being paid off with this amount that you pay.

Whether or not you’re under debt counselling, you will still have to repay your debts. All debt counselling is a solution that makes it easier for you to pay. Under debt counselling, instead of paying all your debts separately, you make the payment to the counsellor and they take care of the rest for you.

Even if your financial circumstances have changed - let’s say you got a raise at work - it is still best to stick with debt counselling. It will ensure that you do not overspend and incorrectly allocate funds.

2. You need to take out additional credit

Of course, you may find yourself in a situation where you need more credit or you need to take out a loan. As we know, you can’t do those things while you’re under debt review. As a result, you may want to withdraw from debt counselling.

But there is a misunderstanding here. Withdrawing from debt counselling won’t make it any easier to get a loan or additional credit.

Even if you successfully withdraw, your records at the NCR will still show that you’re under review and therefore you will still be unable to take out more credit. Withdrawing from debt counselling does not mean your record of being in debt goes away. Creditors and banks will see this and will not give you more loans. .

3. The debt is taking a while to pay off

We recognise that the process is long. But, it was set up this way to make it easy for you to get your debt sorted.

Debt Counselling lasts for 60 months maximum. In these months, your payments will be as low as they can be. In other words, the longer repayment allows you to pay only small amounts per month is what makes repaying much less frightening. The length of time will be worth it, as the massive monthly repayments and high interest rates will be off your back.

The repayment period can be shorter under certain circumstances. For example, if you come into a lump sum of money you can arrange to use it to pay off your debts in one go. Here, you could be given a consolidation amount.

Things to remember before withdrawing from Debt Counselling

Withdrawing from debt counselling comes with a few side-effects. It is important to keep these in mind.

1. You cannot continue replaying reduced instalments without being under debt counselling

When you start your debt counselling journey, your debt counsellors negotiate with your creditors to ensure that your monthly instalments are lower. They get creditors to agree to longer repayment periods and lower interest rates. Creditors agree as they have assurance from the debt counsellor that payments will be made.

This means, under debt counselling, your repayments are reduced. Should you discontinue your debt counselling agreement - you will lose this benefit. Creditors will revert your monthly payments to their original amounts.

2. Waived payments will restart

Another benefit of debt counselling is that your debt counsellors can have certain fees waived. For example, you may have penalties levied against your current accounts for missing payments or for paying too little.

If you remove yourself from debt counselling, these penalties will most likely return.

3. Legal action can be taken against you after withdrawing from the process

When you’re under debt counselling, you are provided special legal protection. The debt counselling ensures that - while you are undergoing the process - your assets cannot be repossessed. They also keep creditors from taking you to court for your missed payments.

Need debt counselling or consolidation?

Explore DebtBusters' solutions for reducing your interest rates and unlocking cash.

Find out moreAs soon as your debt counselling agreement is terminated, creditors have the right to take legal action to enforce a credit agreement that was previously in place. If you do not pay according to the original agreement, the creditor can take you to court to get the payment. In a worst case scenario, your possessions may be repossessed.

Make sure you understand how the process of withdrawing from debt counselling works

If you, at this point, find yourself still wanting to withdraw from debt counselling - let us take you through the process below.

Before 2015, the withdrawal process was easy. All you had to do was contact your counsellor to request a cancellation. They would give you and all other necessary parties a voluntary withdrawal from debt counselling (17.4) form, and it would be over and done with.

Things are different now. In 2015, revised guidelines were issued. Debt counsellors can no longer terminate or withdraw a client from debt counselling.

There is now a strict, and rather long, legal process to follow.

The updated regulations for withdrawing from debt counselling

- You may now only exit the debt counselling process if all of your repayments are taken care of. This does not include home loans, which should be up to date in terms of payments when you withdraw - or else you will not be able to.

- If you meet the above requirement, you can apply to have a court order rescinded or for an order to declare you are no longer indebted. When you get the order, the Debt Counsellor will let the credit providers know by issuing a form and updating the NCR system.

The only other time you can withdraw from debt counselling is before the court order stating you are over-indebted has been issued. In other words, before you make the agreement with the debt counsellor to enter into debt counselling. If you are later in the debt counselling process, you may have to involve attorneys.

Note, however, that a debt counsellor can suspend their service if they feel as though the client is not cooperating.

As you can see, withdrawing is quite a tedious process - and you may even have to spend money on an attorney. None of this is ideal. On top of this, you will still be left to take care of your remaining debt, on your own, at the end of it all.

If you are unhappy with your debt counsellor you can take action

You can lodge a complaint to the NCR if:

- You have been put under debt counselling without due process

- Your debt counsellor is not assisting you and is not providing you with required information

- Your Payment Distribution Agency (PDA) statements do not match the credit providers’ statements.

The NCR commits to resolving complaints within 90 days depending on the complexity and nature of the complaint. Depending on the circumstances, the NCR can end the debt review process if they see fit. They accept emails at complaints@ncr.org.za.

Remember your rights

By law, a credit provider must send you monthly statements. However, the onus is on you to compare these statements with the PDA statement and query any discrepancy. In some cases, credit providers have included fees on the statement that were not part of the court agreement.

You can also transfer to another registered debt counsellor at any stage during the debt review process if you would like to.

Our overall advice is that you need to tread carefully if you want to withdraw from debt counselling.

Leaving the debt counselling process can bring more complications than you expect. While it may seem easier to go it alone, it really isn’t. You’ll have creditors on your back again, higher repayment fees, and more stringent terms. You can avoid this by staying in the process.

But, if you still want to exit, Debt counselling can be cancelled if the following conditions exist:

- You have fully paid all your restructured debts. You may opt to exclude your mortgage agreement provided the bond is up to date.

- You provide all paid up letters to your debt counsellor for them to issue a clearance certificate.

- You may cancel at any time before the court declares you legally under debt review.

- If you were declared, by the court, not to be over-indebted.

Often people see the length of the repayment process or the fact that they can’t take out more credit, and then panic and try to withdraw from the debt counselling process.

We’re here to let you know that you don’t have to worry. All the processes in place are there to help you, not hinder you. Together we can get it sorted.

If you find yourself in financial stress, contact DebtBusters to reduce the burden.

Let us call you back

Fill out our form below to get a free call-back from one of our consultants to discuss your debt situation.

Jump to form