Evidence busts the myth that debt counselling has long-term negative impact on credit scores.

Over-indebted consumers who successfully complete debt counselling have, on average, significantly higher credit scores than those who consider it but do not proceed.

This was the finding of a DebtBusters’ analysis of consumers who applied for debt counselling over the past five years.

Expert opinion on Debt Management and credit scores

Benay Sager, head of DebtBusters, South Africa’s largest and leading debt management company, says the primary driver of a high credit score is the ability and willingness to pay back what is owed. This is true irrespective of whether the person is in debt counselling or not.

“If you pay back your debt, your credit score will not be negatively affected over the long term. Debt counselling provides an effective means to pay back what you’ve borrowed in a structured and affordable way.”

Understanding credit score through the programme

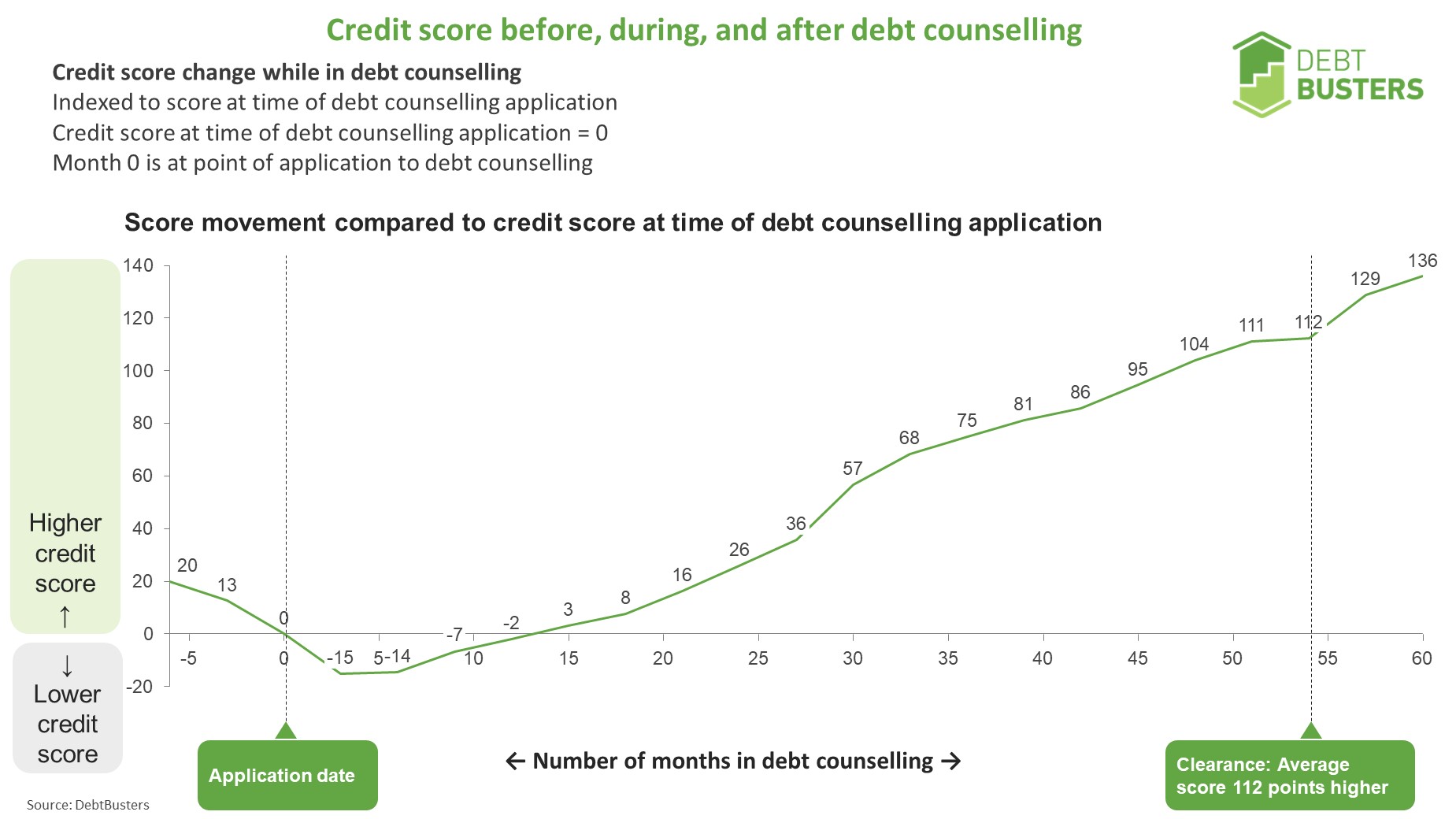

The data shows the impact on the credit score of over-indebted consumers who applied for debt counselling at DebtBusters. These consumers, who stuck to the restructured payment programme, on average completed their debt counselling journey in under five years.

A consumer’s credit score will drop during the first few months of the debt counselling journey. In fact, for many consumers, the credit score is already in decline when they apply for debt counselling as they struggle to make ends meet.

Sager explains the initial decline is to be expected as credit providers receive limited amount of debt repayments during this initial period as per wider industry agreements. Credit providers know they will not receive payments in the first few months, and this is built into the overall programme.

Once negotiations with credit providers are finalised and the consumer continues to pay the new restructured, more affordable repayments a steady increase in their credit score can be seen. By month 12 of the debt counselling journey, the consumer’s credit score is on par with what it was when they applied for debt counselling.

Need debt counselling or consolidation?

Explore DebtBusters' solutions for reducing your interest rates and unlocking cash.

Find out moreThe increase gets even higher post clearance. In fact, consumers who complete debt counselling have an average credit score that is 112 points higher than their starting point.

“The data is unequivocal. It busts the myth that debt counselling negatively affects your credit score over the long term. Over-indebted consumers who enquire about, sign up and successfully complete debt counselling will not only have lower monthly debt repayments by having their debt restructured, but will emerge with significantly higher credit scores than their over-indebted peers who should have signed up but did not,” says Sager.

The importance of your credit score

Sager says your credit score is important because these three digits are what everyone from banks to landlords use to determine how financially dependable you are.

For the financial sector, the credit score is information that is as important as an ID number. A long-term goal of debt counselling is to help consumers improve their credit standing.

Debt Management is the way forward for the over-indebted

“We see that on average, clients who successfully complete debt counselling and obtain their clearance certificates, manage to secure vehicle finance within two months and secure a new home loan within five months. This shows that for dedicated consumers, debt counselling can help turn around their long-term financial standing.”

“The bottom line is that debt counselling is an effective way for over-indebted consumers to restructure their debt and the research shows that those who complete the process will also benefit from an improved credit score.”

For more clarification on this topic, listen to Benay Sager's interview on Smile 90.4 FM.

Let us call you back

Fill out our form below to get a free callback from one of our consultants to discuss your debt situation.

Jump to form